Conventional financial institutions could be hesitant to offer top-notch credit services to borrowers with poor credit. But UK Bad Credit Loans is the best loan service agency to change the notion of getting a bad credit loan—and more! This broker provides different types of loans for bad credit to aid borrowers in boosting their credit rating and getting instant access to quick funding.

You must remember that they are the brokers and not the direct lender! It’s a top-notch loan service agency that lets you access its extensive group of online lenders with a request form. However, today’s article will provide a detailed overview of the best online broker in the UK. So, let’s get started.

UK Bad Credit Loans Overview

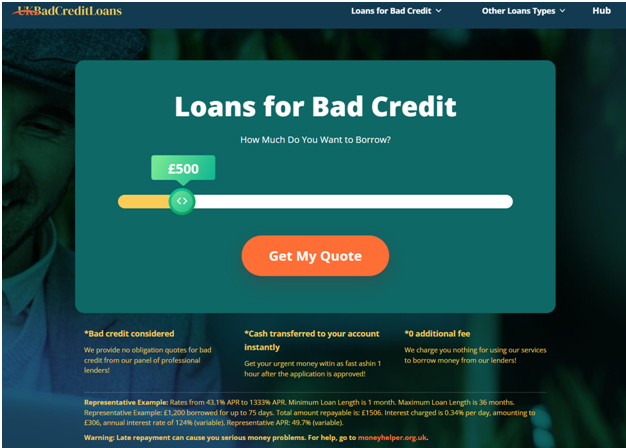

This premium online loan marketplace serves different borrowers seeking different loans for bad credit of up to £5000 or more. This organization accepts different application forms from borrowers with 500 or lower credit scores, comparing every potential borrower with numerous lenders and their poor-credit loan offerings. However, if you won’t be eligible for a payday loan, UK Bad Credit Loans will aid you in finding substitutes for your financial requirements.

It’s a top-notch solution for UK residents who need quick funding to cover unforeseen costs and debts but cannot get loans from traditional banks because of their awful credit. Therefore, instead of filling out a loan application form at a bank, which will never consider your application, you may complete the application form at UK Bad Credit Loans and get a bad credit lender as per your needs.

How to apply for a loan with UK Bad Credit Loans?

Below are the detailed steps to apply for loans with bad credit:

- Apply online

You must fill out an online form after visiting UK Bad Credit Loans and submit the details for further verification.

- Get instant approval

After submitting your loan application, a group of lenders will verify the details. Once done, this platform will let you find suitable lenders as per your needs.

- Evaluate and accept

If the terms and conditions of the online lenders pique your interest, you need to agree to the terms by signing the e-contract.

- Get cash immediately

Once everything is sorted, the lender will quickly distribute the money to your bank account.

How does UK Bad Credit Loans work?

Financial emergencies may pop up anytime, such as huge medical bills, home repairs, or fixing a car. But you can now eradicate your cash-strapped situation by availing of a payday loan with the help of UK Bad Credit Loans.

As per the reviews from the borrowers, you may expect to obtain funds within the same day or the next day. But the loan processing time might vary from one lender to another; hence, the process might take longer.

Loan Requirements

The detailed loan requirements for getting an approved loan amount via UK Bad Credit Loans are the following:

- Must be approximately 18 years old.

- Must have a bank account.

- Must be a permanent UK resident.

- Must have a steady flow of income.

- Must have a legit phone number or email address.

UK Bad Credit Loans: The best online broker

This loan service agency sometimes understands how unexpected or emergency bills could hit you hard and give you a feeling of hopelessness when there’s no way of getting urgent cash. To help you out, UK Bad Credit Loans is here!

They serve as a connection between the borrowers and lenders and make the process hassle-free by getting instant approval and funds within a day from their extensive network of online lenders. They’re committed to helping all borrowers, regardless of their financial situation or credit score.

Why choose UK Bad Credit Loans?

This broker provides 24/7 services, which allows borrowers the super-fast requirement of instant money. While applying for a loan with this broker, the biggest benefit you will enjoy is that it’s easy to submit an application form and get instant money. In addition, they are ready to guide you whenever you’re having trouble getting access to instant cash to mitigate your financial jeopardy.

Pros and Cons of UK Bad Credit Loans

Pros

- No collateral is needed.

- Instant funding is available once the loan application is approved.

- Personal loans of up to £5,000 for individuals with bad credit.

- No origination fees and a competitive APR.

Cons

- They’re not direct lenders.

- The below 500 credit score holders can’t borrow over £1000.

Conclusion

In a nutshell, choosing UK Bad Credit Loans is the best broker you can avail of the best loan terms. This broker and the lenders will never violate any rules and provide the best loans to the applicants. So, if you are considering borrowing money any time soon, it can be relied upon without worrying too much.